Detailed settlement report

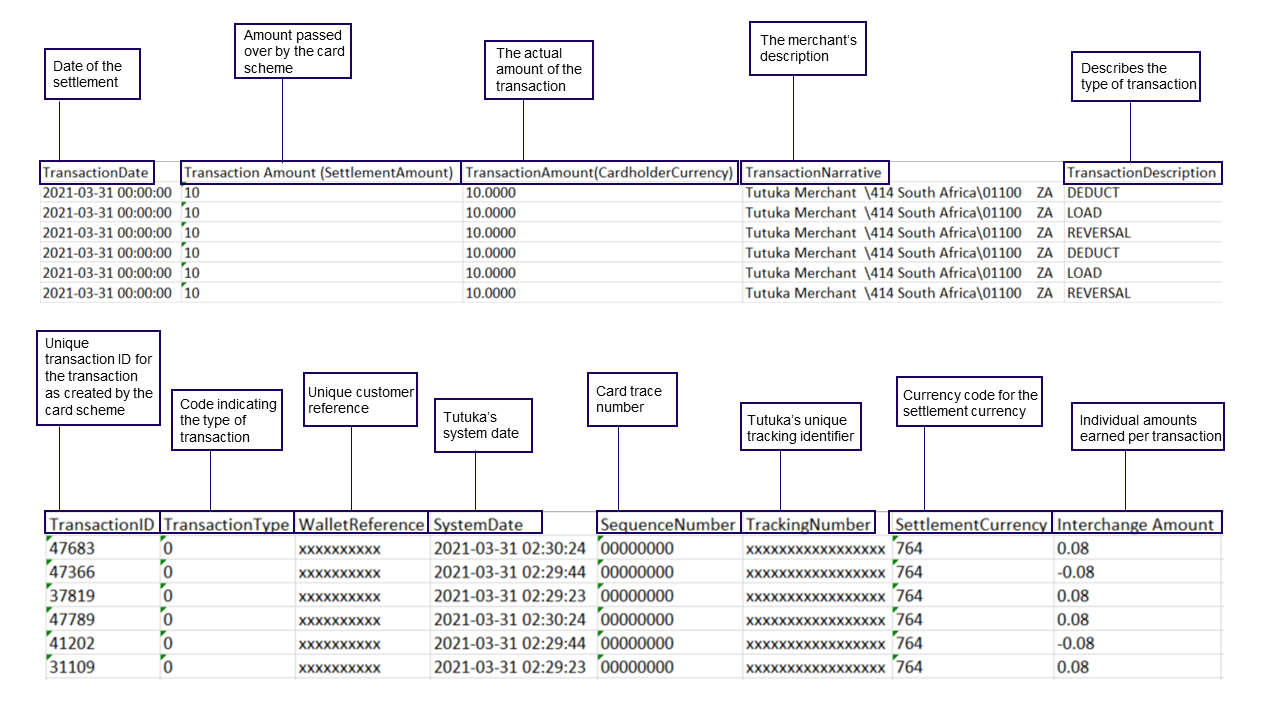

Paymentology also provides a detailed version of the Summary Settlement Report. The Detailed Settlement Report shows each settled transaction, which allows you to use the Transaction ID to mark off settled transactions from authorized transactions. This also assists in confirming the values of the amounts in the Summary Settlement Report. The network provides the Transaction ID field during authorization. The same Transaction ID for authorizations is included in the Detailed Settlement Report.

There are 3 versions of this report available:

Version 1.0

The report includes the following details:

Version 1

Contains the Chargeback report

- Transactions date – this is the settlement date of the transaction.

- The amount in the issuing currency (cardholder currency) – the actual amount is a decimal number.

- The amount in the settlement currency – it’s the amount passed over by the network. It should be multiplied by 100 to include cents. If the settlement currency does not have decimals, you’ll take the value as-is.

- Transaction narrative – it’s the merchant’s description.

- Transaction description – this describes the transaction type, such as:

- Deduct – shows all deductions at the time of settlement.

- Load – shows refunds.

- Chargeback – gives positive or negative amounts for chargebacks.

- Transaction ID – it’s a reference for the transaction.

- In most cases, the provided Transaction ID will be the same Transaction ID as the original authorization. It’s usually 7 to 10 digits.

- In case of refunds, there will be a unique Transaction ID for each of them. The ID does not relate to the original authorization. It’s also longer, up to 23 characters.

- In case of chargebacks, there will be a unique Transaction ID for each of them. The ID does not relate to the original authorization. It’s also longer, up to 23 characters.

- Currency code – this is the currency code for the settlement currency.

- Transaction types – they can be marked as 00 (for POS transactions), 01 (for ATM transactions), or 02 (for adjustment transactions).

- Wallet reference – this column will be empty for Card API reporting.

- System date – this is Paymentology’s system date in UTC +2 time zone.

- Sequence number – this is a unique sequence card identifier showing a running number for the cards created.

- Tracking number – this is a unique 15-digit tracking identifier for the card.

- Settlement currency – this is the currency code for the settlement currency.

- Interchange amount – this is the individual amounts earned per transaction.

Version 2.0

Does not contain the Chargeback record (see Transaction Description column).

- Transactions date – this is the settlement date of the transaction.

- The amount in the issuing currency (cardholder currency) – the actual amount is a decimal number.

- The amount in the settlement currency – it’s the amount passed over by the network. It should be multiplied by 100 to include cents. If the settlement currency does not have decimals, you’ll take the value as-is.

- Transaction narrative – it’s the merchant’s description.

- Transaction description – this describes the transaction type, such as:

- Deduct – shows all deductions at the time of settlement.

- Load – shows refunds.

- Transaction ID – it’s a reference for the transaction.

- In most cases, the provided Transaction ID will be the same Transaction ID as the original authorization. It’s usually 7 to 10 digits.

- In case of refunds, there will be a unique Transaction ID for each of them. The ID does not relate to the original authorization. It’s also longer, up to 23 characters.

- In case of chargebacks, there will be a unique Transaction ID for each of them. The ID does not relate to the original authorization. It’s also longer, up to 23 characters.

- Currency code – this is the currency code for the settlement currency.

- Transaction types – they can be marked as 00 (for POS transactions), 01 (for ATM transactions), or 02 (for adjustment transactions).

- Wallet reference – this column will be empty for Card API reporting.

- System date – this is Paymentology’s system date in UTC +2 time zone.

- Sequence number – this is a unique sequence card identifier showing a running number for the cards created.

- Tracking number – this is a unique 15-digit tracking identifier for the card.

- Settlement currency – this is the currency code for the settlement currency.

- Interchange amount – this is the individual amounts earned per transaction.

Version 2.1

Builds off of V2.0 and does not contain the Chargeback record. Changes include additional information to TransactionNarrative column delimited by pipes eg. TransactionNarrative|AdditionalTraceRef|CustomIdentifier

- Transactions date – this is the settlement date of the transaction.

- The amount in the issuing currency (cardholder currency) – the actual amount is a decimal number.

- The amount in the settlement currency – it’s the amount passed over by the network. It should be multiplied by 100 to include cents. If the settlement currency does not have decimals, you’ll take the value as-is.

- Transaction narrative|AdditionalTraceRef|CustomIdentifier – it’s the merchant’s description.

- Transaction description – this describes the transaction type, such as:

- Deduct – shows all deductions at the time of settlement.

- Load – shows refunds.

- Transaction ID – it’s a reference for the transaction.

- In most cases, the provided Transaction ID will be the same Transaction ID as the original authorization. It’s usually 7 to 10 digits.

- In case of refunds, there will be a unique Transaction ID for each of them. The ID does not relate to the original authorization. It’s also longer, up to 23 characters.

- In case of chargebacks, there will be a unique Transaction ID for each of them. The ID does not relate to the original authorization. It’s also longer, up to 23 characters.

- Currency code – this is the currency code for the settlement currency.

- Transaction types – they can be marked as 00 (for POS transactions), 01 (for ATM transactions), or 02 (for adjustment transactions).

- Wallet reference – this column will be empty for Card API reporting.

- System date – this is Paymentology’s system date in UTC +2 time zone.

- Sequence number – this is a unique sequence card identifier showing a running number for the cards created.

- Tracking number – this is a unique 15-digit tracking identifier for the card.

- Settlement currency – this is the currency code for the settlement currency.

- Interchange amount – this is the individual amounts earned per transaction.

Report format

| FORMAT | FILE NAME | FREQUENCY | ACCESSIBILITY |

|---|---|---|---|

| CSV | [CampaignUUID]/[CampaignName]DailySettlements[YYYYMMDD].csv | Daily | HTTP get request or client SFTP folder |

Report time frame

| UTC +2 | UTC +7 | REMARKS |

|---|---|---|

| 04:00 | 09:00 | When the report is generated at 04:00 UTC+2 / 09:00 UTC+7 2020-09-10, the timeframe of all the settled transactions captured in this report is from 2020-09-09 00:00:00 to 2020-09-09 11:59:59 in: • System time zone UTC+2 • Asia client time zone UTC+7 • Merchant time zone |

Report sample

Note: file will automatically download upon clicking link